Did you know that the FinOps market is worth a massive $5.5 billion and is projected to grow at an impressive 34.8% CAGR from 2023-2025? That's right, the rising need for cloud cost management and cloud cost optimization has fueled the demand for FinOps. But it's not enough to know that cloud FinOps is important.

Are you aware of the challenges organizations are facing today that make FinOps so necessary? Where does the FinOps market stand today and what are the key drivers and growth trajectories? Are you up to speed with these latest trends and insights in the cloud FinOps sphere? If not, this blog will be extremely helpful.

This blog packed with data-driven insights is based on a survey conducted by Everest Group across 450 global organizations.

By understanding these dynamics, you can benchmark your FinOps approach and identify areas for improvement. Also, learn about the market needs and how it's changing. Make sure to align your strategies following the latest trends in cloud FinOps and decoding what your competitors might be doing correctly.

The insights in the blog are segregated as below:

- The current state of Cloud Adoption.

- The key cloud challenges driving FinOps adoption.

- Global Cloud FinOps Trends and Insights.

- The key challenges within Cloud FinOps adoption.

- The tracking of cloud cost optimization and FinOps practices.

- What’s Ahead in Cloud FinOps?

- Insight on the State of Cloud FinOps Providers’ Landscape.

The current state of Cloud Adoption

Let's start with understanding the current scenario of cloud adoption in more detail.

1. 67% of organizations have more than 60% of their workload on the cloud.

The unique benefits of cloud services are positioning it as a strategic pillar for the next generation extending beyond just IT and becoming a more widespread and essential requirement.

Many companies in Asia-Pacific (APAC) and Europe now use the cloud for 60-80% of their workloads, showing a noticeable increase in adopting cloud services in these regions.

2. 78% of organizations prefer either a hybrid cloud or multi-cloud strategy.

Most companies prefer using either hybrid cloud or multi-cloud strategies to avoid vendor lock-in issues and to adopt the best-of-breed approach for their cloud workloads. In the Asia-Pacific (APAC) region, there's a greater preference for private cloud, while in North America and Europe, multi-cloud adoption is more popular.

The key cloud challenges driving FinOps adoption.

Let us look at the primary challenges faced by organizations in cloud management that are fueling the demand for FinOps solutions

3. 67% of organizations experience higher-than-expected cloud costs. (Source: Everest Group’s annual key issues survey)

67% of global organizations believe that they have experienced higher than anticipated cloud costs as opposed to their initial expectations of cost reduction from cloud adoption.

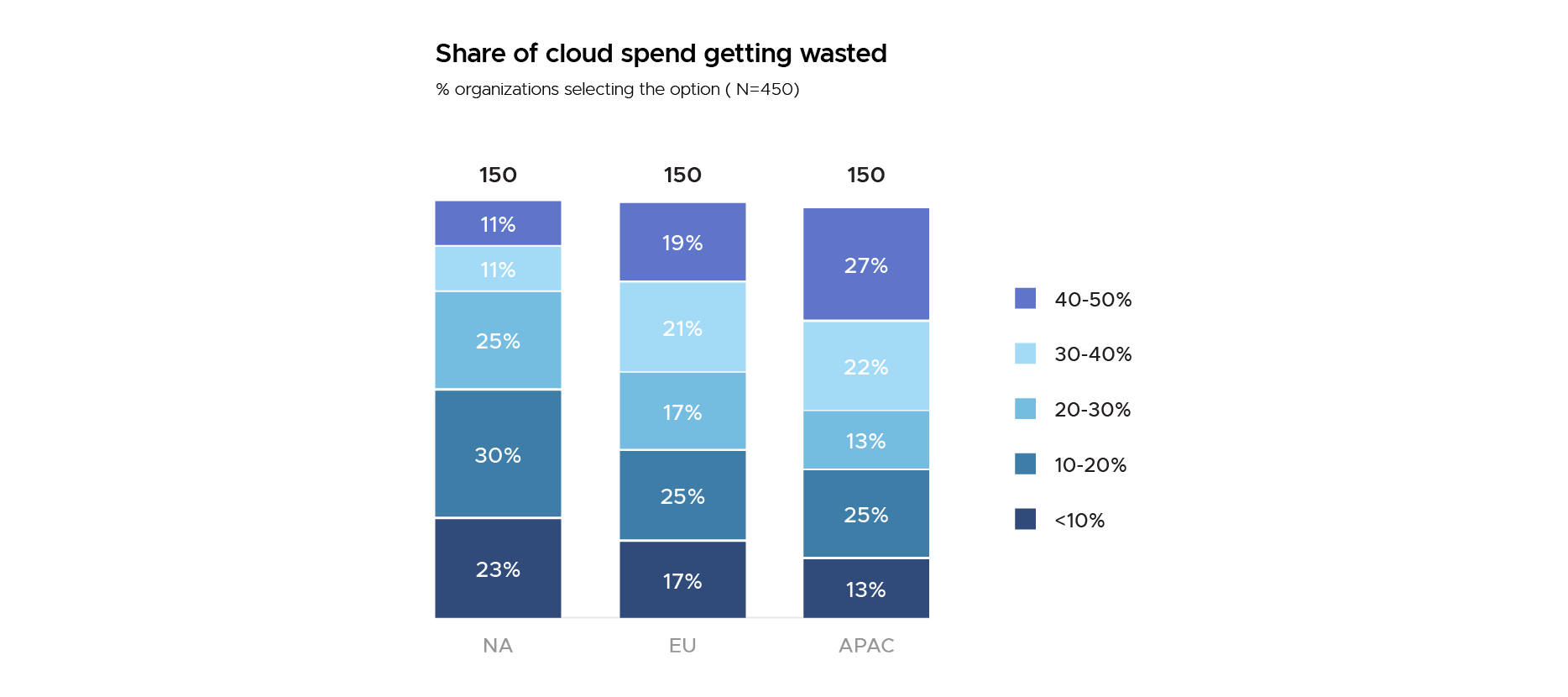

4. 82% waste at least 10% of their cloud spend. (Source: Everest Group’s annual key issues survey)

82% of global organizations struggle with more than 10% of their cloud spending getting wasted, out of which 68% experience more than 20% wastage.

5. Cloud cost wastage is a significant concern globally with 38% of organizations experiencing more than 30% of their cloud spending getting wasted.

The survey suggests that most organizations are still fine-tuning their cloud operating model leading to over-provisioning and underutilization of cloud resources. This is creating a hurdle in effective cloud cost management.

6. 41% of the organizations experiencing more than 30% of wastage on cloud spend belong to Europe.

The reason behind this lies in the accelerated adoption of the cloud during the pandemic. This rapid adoption resulted in poorly planned strategies, leading to higher instances of wastage.

7. In the Asia-Pacific (APAC) region, 49% of organizations witness over 30% wastage in their cloud expenditures.

Notably, countries like India see more than 50% of organizations wasting over 40% of their cloud budget.

8. In North America, less than 25% of organizations experience more than 30% wastage.

Contrary to the statistics of the APAC region, the advanced maturity of cloud operating models is evident, emphasizing the region's well-established proficiency in cloud management.

Global Cloud FinOps Trends and Insights

Now that we have a clearer understanding of cloud adoption and the challenges driving the demand for cloud FinOps, let's dive into the current landscape. We'll explore key statistics and trends to gain a comprehensive insight into the global FinOps scenario.

9. 63% of organizations dedicate more than 7% of their cloud spend to FinOps.

This allocation reflects a growing awareness of the relevance of optimized cloud FinOps and potential cost-saving benefits that can be realized through strategic investments in FinOps practices. They understand the need to invest significantly in FinOps to cut costs and support business growth.

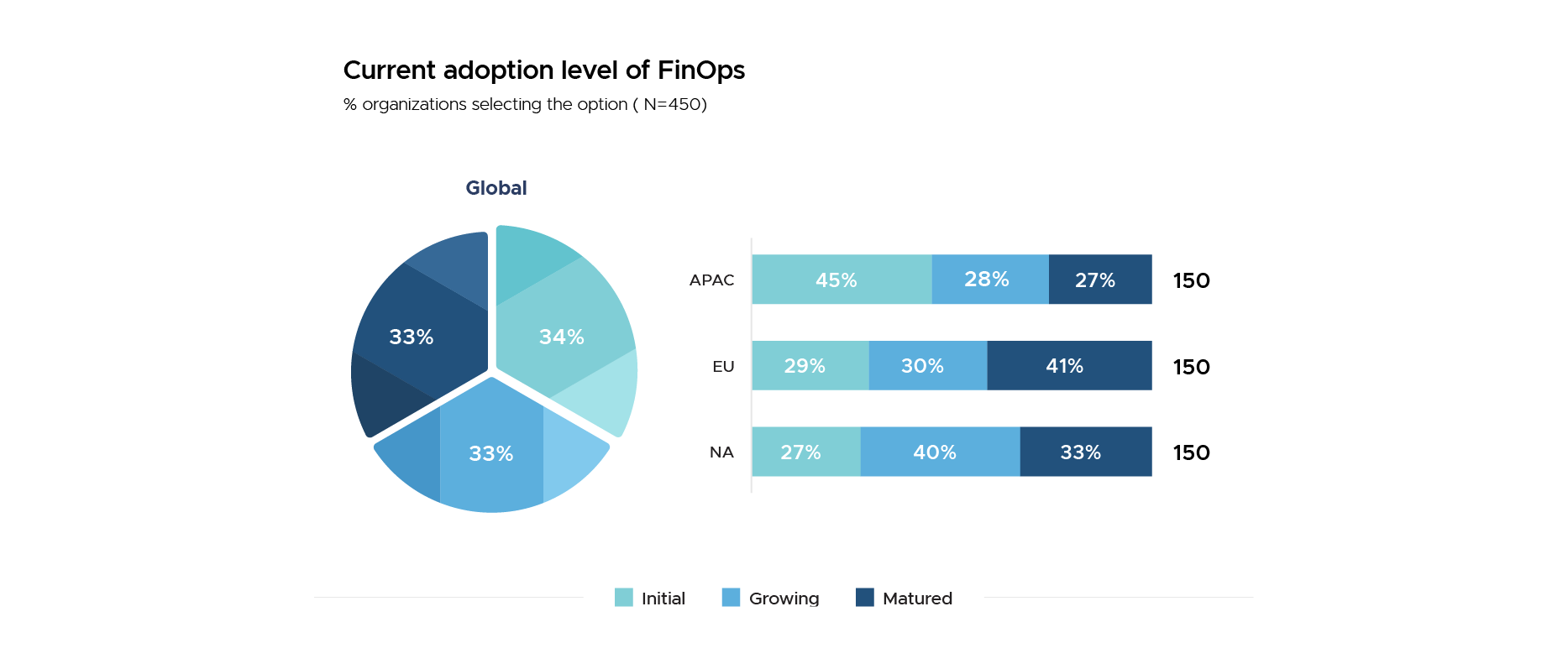

10. 34% of organizations are at the initial stage of adopting FinOps.

We can see a notable presence of APAC organizations in the early stages of FinOps. Meanwhile, 40% of North American players are in the growth phase of their cloud FinOps adoption journey. This highlights the increasing maturity of FinOps adoption in North America, emphasizing organizations' growing concerns about cost control and effective resource allocation.

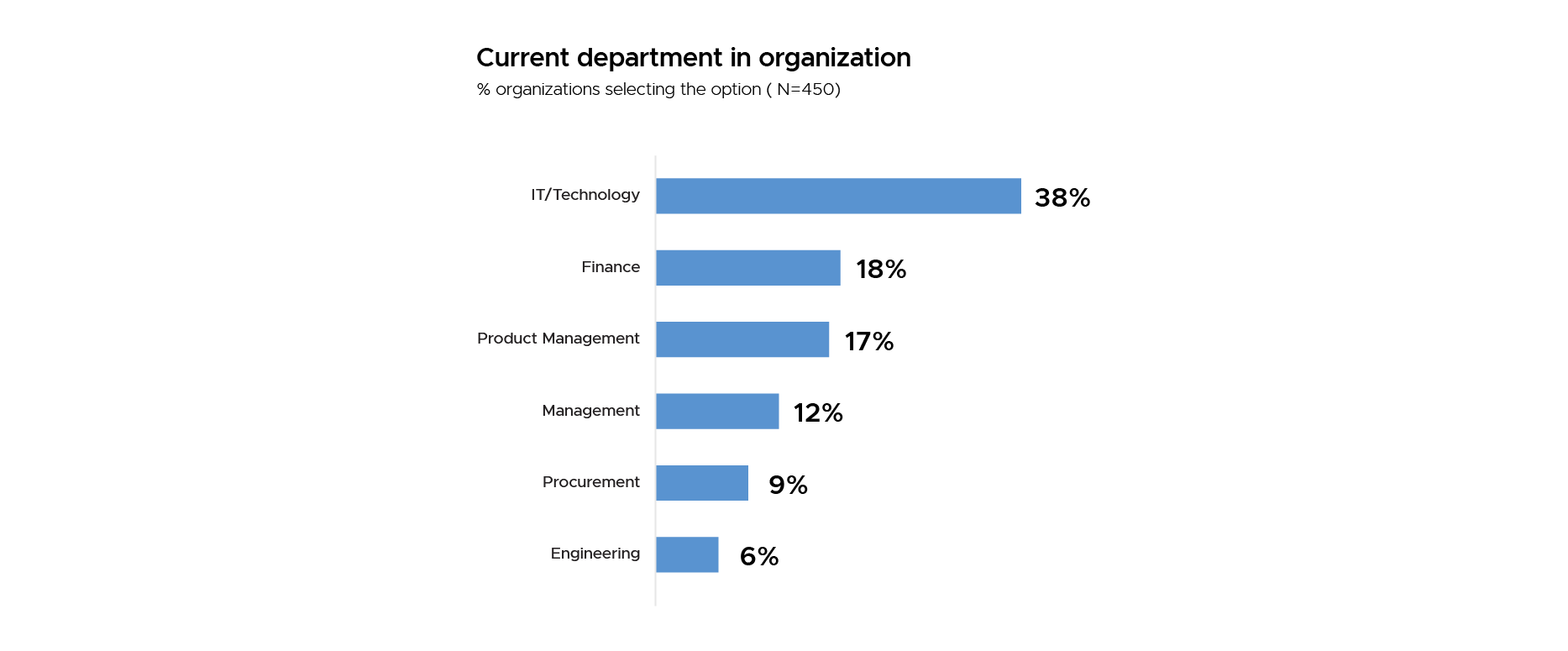

11. IT/Technology holds the highest representation with a substantial 38% participation in FinOps activities.

IT/Technology holds the highest representation with a substantial 38% participation in cloud FinOps activities. Management, representing 12%, indicates a significant presence of business and management leaders in the decision-making processes related to cloud financial operations.

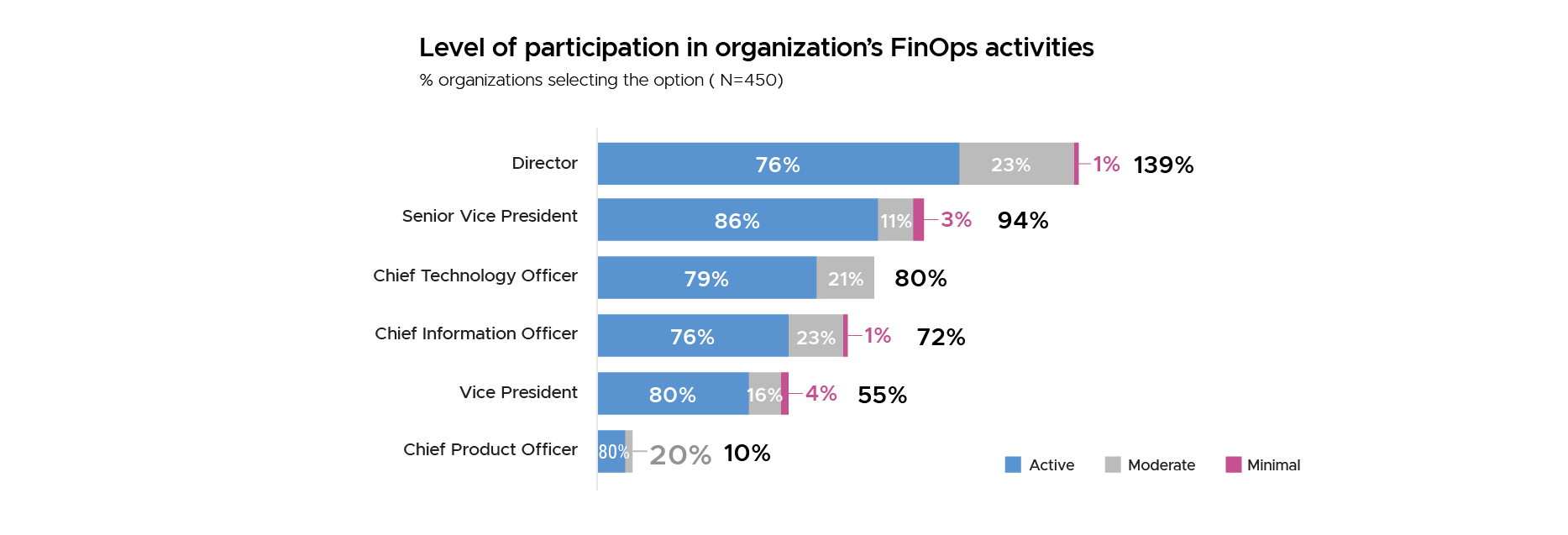

12. 86% of Senior Vice Presidents (SVPs) and 80% of Vice Presidents (VPs) are actively involved in their organization’s FinOps activities.

Senior Vice Presidents (SVPs) and Vice Presidents (VPs) play a significant role in FinOps activities, actively influencing the strategic direction of their business units. Their active involvement ensures alignment with organizational goals.

Furthermore, Directors, Chief Information Officers (CIOs), and Chief Technology Officers (CTOs) regularly participate in the organization's FinOps activities.

13. 45% of organizations with advanced cloud adoption prioritize immediate cost savings.

This drives the integration of FinOps practices to optimize expenditures, enhance efficiency, and strategically allocate resources.

The key challenges within Cloud FinOps adoption

While Cloud FinOps adoption is increasing, several barriers are hindering its effective implementation. Let's uncover these obstacles.

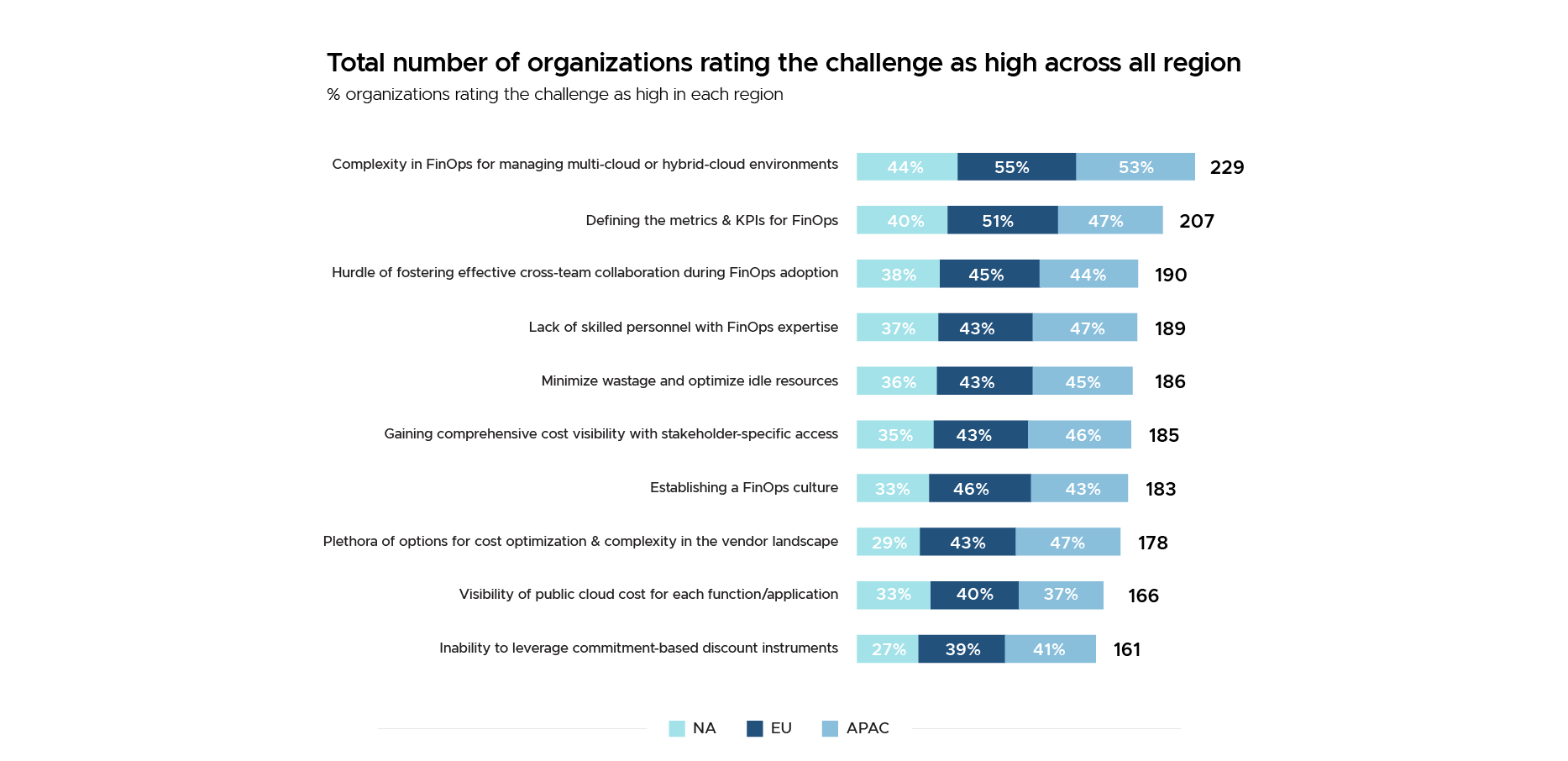

14. 51% of global organizations struggle with managing diverse cloud platforms and hybrid infrastructure.

There is a requirement for best practices in optimizing these diverse environments. This is mainly due to the intricacies of cross-cloud operations, redundant costs, overprovisioned processes, and tools, as well as challenges related to data gravity and integration.

Organizations also express dissatisfaction with adopting key organizational elements of FinOps. This includes issues like cross-team collaboration, establishing internal cloud FinOps KPIs and metrics, and the recruitment and retention of FinOps-certified professionals.

15. 46% of global organizations struggle to comprehensively grasp their cloud unit economics.

There is the difficulty faced by organizations in defining metrics and KPIs for Cloud FinOps. This challenge leads to a lack of clear correlation between cloud costs and the corresponding business value at the specific use-case level.

16. 43% prioritize overcoming ineffective cross-team collaboration during FinOps adoptions.

The organizational silos and communication barriers can hinder effective teamwork, causing misalignment between financial goals and operational realities.

17. 42% of global organizations face challenges due to a shortage of skilled personnel proficient in FinOps practices.

A lack of skilled personnel with Cloud FinOps expertise can hamper the effectiveness of FinOps teams and may impact the optimal management of cloud costs and operational efficiency.

The tracking of cloud cost optimization and FinOps practices

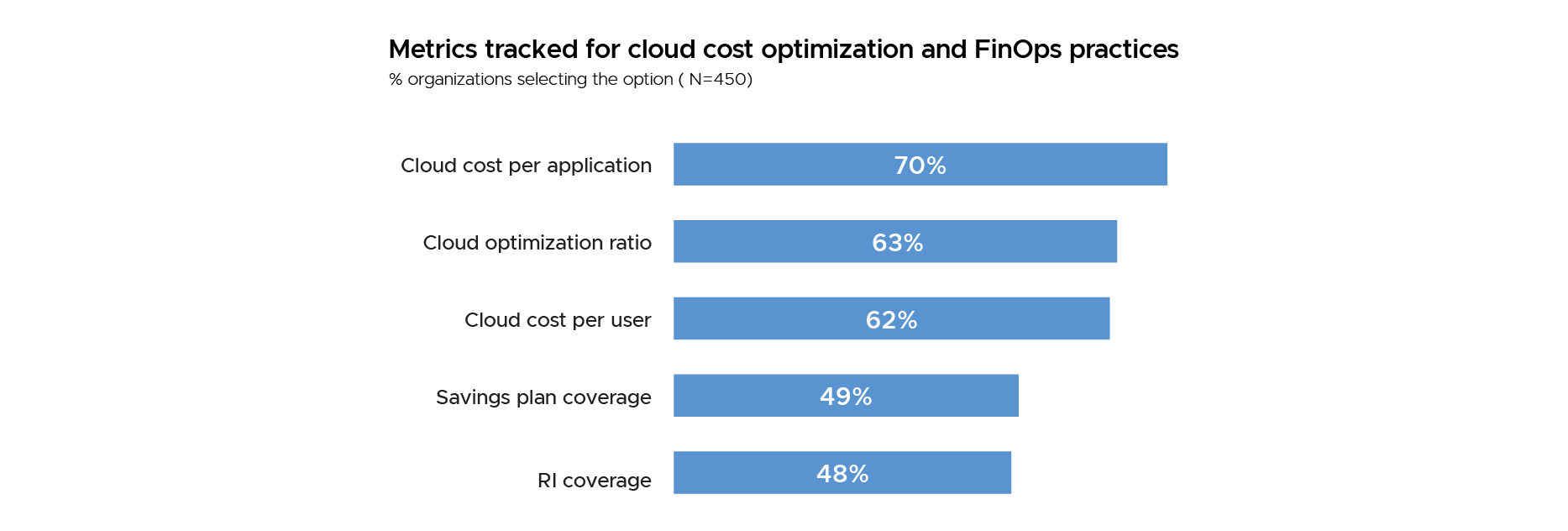

18. More than 70% of organizations track cloud cost per application to assess FinOps practices.

However, this cloud cost per application metric overlooks crucial details like monitoring overprovisioned resources and continuous wastage.

We can observe a growing importance of metrics related to Reserved Instances (RIs) and savings plans. However, not many organizations have adopted these metrics, indicating a limited maturity in Cloud FinOps implementation and tracking.

Looking forward, as the market matures, we can expect FinOps metrics to consider factors like engineering costs, providing relevant cost data to stakeholders, aligning business value with costs, and enhancing the granularity of cost visibility.

What’s Ahead in Cloud FinOps?

19. Over 35% of organizations anticipate a rise in automation practices within FinOps.

This is due to the perceived shortcomings of current automation-led FinOps tools in meeting organizational expectations as well as the lack of a holistic approach by FinOps providers.

20. Over 50% of organizations expect FinOps tools and services to expand to cover multi- and hybrid cloud environments.

The next set of innovation areas within Cloud FinOps are expected to be embedded automation, provision of support for hybrid cloud environments, as well as cost linkages with business value.

Insight on the State of Cloud FinOps Providers’ Landscape

Let us now understand the current state and future FinOps Providers’ Landscape through the survey insights

21. There is a strong dependence on 3rd party solutions and platforms.

- Organizations primarily opt for tools offered by Cloud FinOps solution providers, mainly because other types of solutions lack advanced Cloud FinOps capabilities.

- While cloud visibility and management platforms, open-source tools, and tools native to hyperscalers are widely available, they often lack a detailed view and comprehensive support.

- Furthermore, there's a shortage of internal Cloud FinOps talent, which diminishes the effectiveness of internally developed solutions.

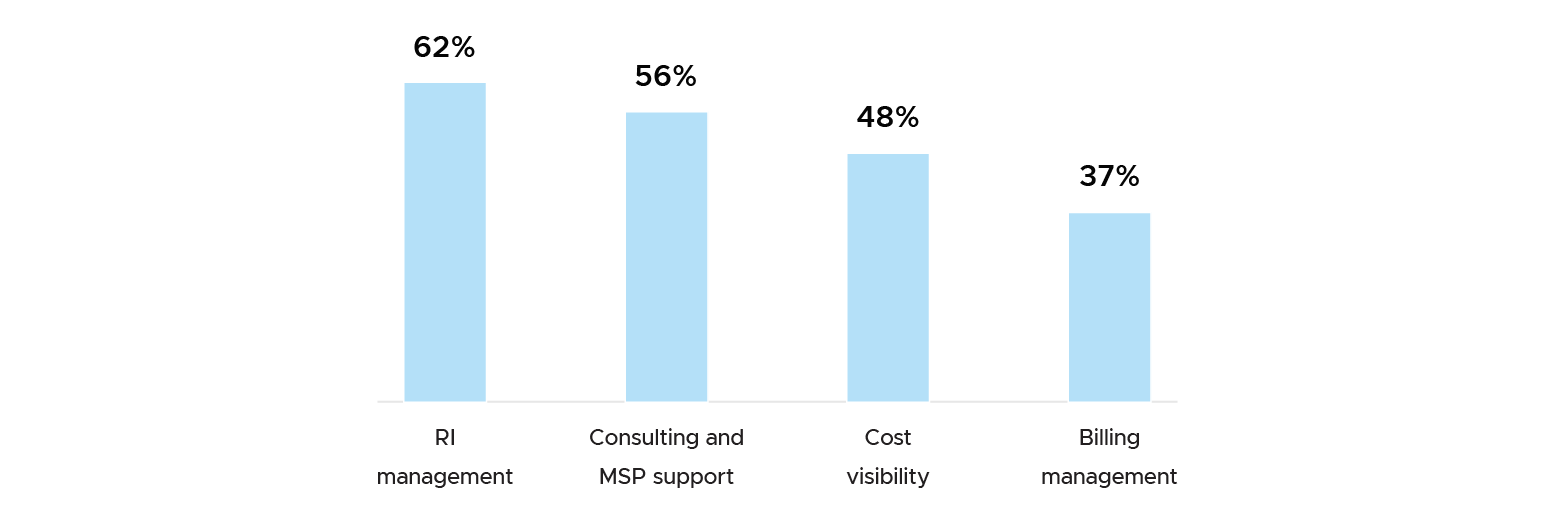

22. 62% of organizations chose RI management providers as the preferred partner for their FinOps strategy.

Organizations are looking for partners to assist them in leveraging RIs across their multi-cloud environments.

There's a growing need for consulting and Managed Service Provider (MSP) support, reflecting a desire for ongoing assistance throughout the Cloud FinOps journey.

As the market progresses, we anticipate a consolidation in the landscape, with end-to-end Cloud FinOps consulting companies operating across all four areas gaining prominence.

23. Over 50% of current FinOps engagement models heavily favor outcome-based and fixed price + outcome-based pricing.

Due to the nature of cloud FinOps, it is most likely to continue having a result-oriented construct.

FinOps Provider-Specific Pricing Dynamics:

- RI Management Segment: Providers in this segment are highly inclined towards outcome-based pricing.

- Cloud Observability and Management Platform Providers: Prefer a fixed fee pricing model.

- Consulting and MSP Providers: Show a preference for charging based on Time and Material (T&M) or fixed-price models.

There's a high probability of increased adoption of outcome-based + fixed fee pricing models. This approach allows providers to charge for non-monetary and process-focused aspects of FinOps implementation.

Conclusion

The data and statistics indicate a rising demand for Cloud FinOps solutions despite existing challenges. However, these challenges underscore the necessity for end-to-end cloud FinOps providers capable of addressing multiple obstacles.

Everest's analysis identifies CloudKeeper as one such end-to-end cloud cost optimization and FinOps provider. CloudKeeper offers a comprehensive suite of cloud FinOps solutions.

CloudKeeper has helped more than 300 organizations overcome diverse challenges associated with cloud FinOps adoption(as shown in this blog) and establish a framework to track cloud FinOps ROI using suitable metrics. It has become a one-stop solution for organizations in need of RI management, cost savings & billing management, consulting & MSP support, and visibility & recommendation solutions. It has also been validated as a partner specializing in Rate, Usage, and Process Optimization.

To understand in detail how CloudKeeper can help in your cloud FinOps journey, connect with our team today.