The FinOps market has grown at a compound annual growth rate of 35.2% since 2019. Future growth is expected to outpace the IT market for several years. Many companies report to IDC that they are still overspending on their public cloud. As IT budgets tighten, wasted cloud spending eats up future investments. As the market growth suggests, enterprises are increasingly turning to FinOps practices and tools to gain control of their cloud costs.

Choosing the right vendor to help implement and mature your FinOps practice can be challenging. As our last blog covered, there are over 65 active software tool vendors in the FinOps market. This blog will focus on selecting the right FinOps partner for your organization.

A reliable partner will provide your company with many vital FinOps capabilities. A partner can assist with selecting the best cloud cost optimization tool by matching your requirements with the strengths of the leading cloud cost tools. Configuring, training, and adopting the cloud cost tool are standard services. A FinOps partner can also guide you through best practices and avoid obstacles when defining your FinOps processes. Identifying the proper personas within your organization will ensure collaboration between stakeholders with a focus on delivering business outcomes. An outside partner can often identify areas of weakness and drive, enabling your processes to mature through accountability and proper goal-setting.

Below is a checklist of things to consider when comparing FinOps partners for this strategic area:

Training and certifications: Confirm the partner’s consultants have individual certifications, such as FinOps Foundation Certified Practitioners and the more complex Certified Professional designation. A partner can also receive FinOps Service Provider certification for their entire organization as well. This will ensure the partner consistently applies best practices at your enterprise.

Architecture, customization, and flexibility: Architecting your FinOps solution and services to your specific needs is vital. There is no one-size-fits-all solution. The dynamic nature of the public cloud means the FinOps vendor needs to see the bigger picture, understand your desired business outcomes, and engineer a flexible solution to meet those requirements.

Customer references: Check a partner's track record and customer testimonials. An established FinOps partner should be able to demonstrate customer success stories around cost optimization, FinOps adoption, and maturity.

Multicloud platform experience: Ensure the FinOps partner has expertise with your specific cloud platforms (e.g., AWS, Azure, and Google Cloud). The partner must be familiar with the nuances of your platform(s) to provide the best optimization strategies.

Automation tooling and AI technology: Assess cutting-edge technologies, the FinOps partner created in-house, that may increase your FinOps team’s business value. These tools often leverage AI to find anomalies faster and quickly customize business dashboards. Automation is vital to driving the implementation of cloud optimization recommendations and realizing savings for your company.

Industry experience: The partner should have a general understanding of your industry and unique use cases. FinOps processes and personas may vary from industry to industry. Compliance and regulations may require consideration for cloud optimization strategies.

Regulatory compliance and security: The FinOps partner should know your company's security requirements to ensure recommendations do not cause compliance issues or vulnerabilities.

Reporting and forecasting: An experienced FinOps partner recognizes the importance of cloud forecasting and the processes of continual improvement related to cloud spending. Working to provide best practices and streamlined processes to create and update your forecast multiple times per year is often high on the list of CFOs for the FinOps team.

Easy-to-understand pricing structure: Public cloud management is complex, so understanding your partner's fee structure should not be difficult. A transparent pricing model for one-time projects and ongoing services will keep your company and partner aligned.

Partnership: FinOps is often a journey, not a transactional short-term engagement. Does your potential partner view the engagement as a long-term collaboration? The partner should have experience in providing training and skills transfer for FinOps processes. This will ensure your team is self-sufficient in the long term.

Growth and scalability: Can your potential FinOps partner's services and capabilities scale and grow with your business? Your partner should adapt and adjust to your ever-changing business requirements over time. Do they have references for successful projects with companies your size or larger?

Communication and reporting: Collaboration and communication are critical for a FinOps team. Setting up customized reports that track FinOps metrics and show impact to business leaders in an easy-to-use report is necessary for most engagements. Communication is also essential between the customer and external FinOps partner. The partner should provide frequent updates and project status milestones.

Commitment-based pricing discounts: Some partners offer access to unique marketplaces of reserved instances and other pricing options besides optimizing your cloud resources via the cloud cost tool. These longer-term savings can add business value to standard FinOps cost optimizations.

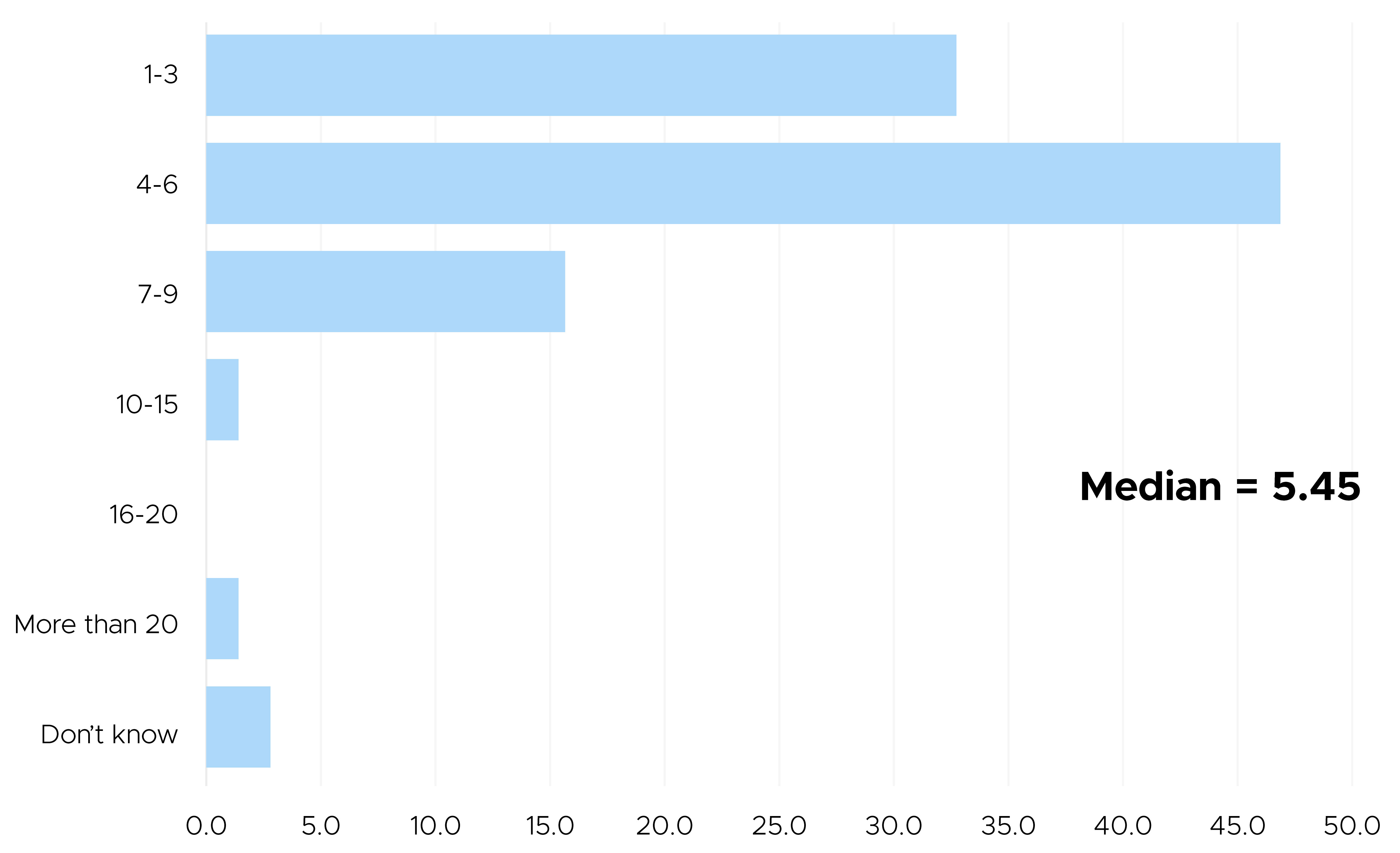

Another element a FinOps partner can assist with is properly selecting who and how many employees should participate regularly on your FinOps team. A tool and proper processes are important but choosing the right people for your FinOps team is essential. Many members will work part-time and serve other roles in your organization the rest of the time. However, one or more may be full-time practitioners who hold all members accountable and drive business reports with the support of their executive FinOps sponsor. The below figure demonstrates the typical size of the FinOps team among Global 2000 enterprises, with a median size of 5.45 members.

(Source: IDC's Intelligent CloudOps Survey, October 2023; n= 104)

After reviewing the checklist of critical FinOps factors, companies can identify a solid match with prospective FinOps partners and move to the next step. Assigning a weighting to factors that deliver the most business value to your company is expected and can help with the selection. You can then identify areas of improvement with people, processes, and tools/technology that your FinOps partner can assist you with first.

Conclusion

The importance of cloud FinOps in organizations is on the rise. However, with varying FinOps maturity across organizations, it is essential to find the appropriate partner who can help adopt FinOps, optimize cloud costs, as well as help you track these metrics. CloudKeeper is a cloud FinOps & cost optimization solution that offers instant and guaranteed savings of up to 25% on the entire cloud bill. It has helped 300+ global customers and delivered over $100 mn savings with an average of 20% of savings without any cost, effort, access or lock-in. CloudKeeper is an AWS Premier Partner and FinOps Foundation Premier Partner with over 12 years of experience in cloud cost optimization and FinOps. Learn more about CloudKeeper here.